Some businesses go down in a blaze of glory. Others quietly fizzle out. No matter which field you are working in, you need to know that it is necessary to formally dissolve your business once you decided to stop operating it.

As the government has rolled out a series of preferential policies and measures for the development of micro, small and medium enterprises (SMEs), there are numerous newly registered companies in China in recent years.

Some may need to close their businesses due to economic conditions, low profits, tough competition, etc. It is difficult for business owners to close their company, however, they can’t just leave it and stop running.

Boss, if you decide to close your company or your business is on the verge of going bust, please cancel your business registration! Otherwise, there may be some legal consequences such as heavy fines and travel restrictions.

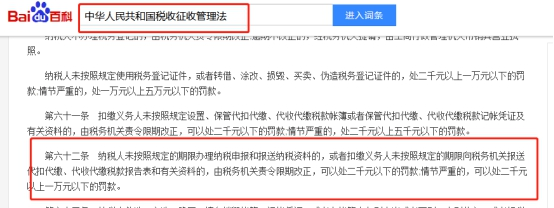

BLACKLISTED BY TAX AUTHORITY

1. Offense disclosure & heavy fines

China’s State Administration of Taxation (SAT) has implemented measures to what is known as the blacklist system against tax illegalities, which came into effect in 2016.

According to the policy, tax-related offenses including refusing to declare taxes or filing false tax declaration will be recorded in the information publicity system and made public, which will affect the offender’s tax credit.

However, if offenders can fully pay the taxes and fines (normally 2,000 yuan – 10,000 yuan), the related info will be recorded but not disclosed to the public.

Therefore, if you still want to operate your business and keep a good record of your credit, you need to make sure that your company is not blacklisted. Canceling your business registration in time or submitting annual report regularly can get you out of economic loss and other troubles.

However, some businesses go down in a blaze of glory, others quietly fizzle out. You do a little less business one month, and then even less and eventually nothing at all. Either way, a day comes where you know it’s all over.

2. Newly registered company to be affected

As all affiliates are recorded in the SAT’s system, the involved offenses may affect the offender’s affiliate companies, such as adding cost and time of tax-related process.

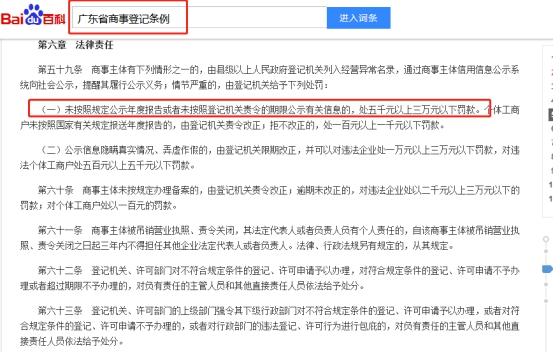

LISTED AS ENTERPRISE WITH ABNORMAL BUSINESS OPERATIONS

1. Offense disclosure & heavy fines

According to China’s State Administration for Industry and Commerce (SAIC), a company will be given the status of abnormal business operations if it has ceased operations for quite a long time or fails to submit annual return on time.

Meanwhile, the Regulations of Guangdong Province on Commercial Registration stipulates that a company will be fined up to 30,000 yuan if it fails to submit annual report or disclose related info as required.

The offense will be recorded by the State Administration for Market Regulation (SAMR) and disclosed to the public via the credit information disclosure system.

If the company handles it within 3 years, the status can be removed. Otherwise, it may be listed as an enterprise with serious illegal and dishonest acts.

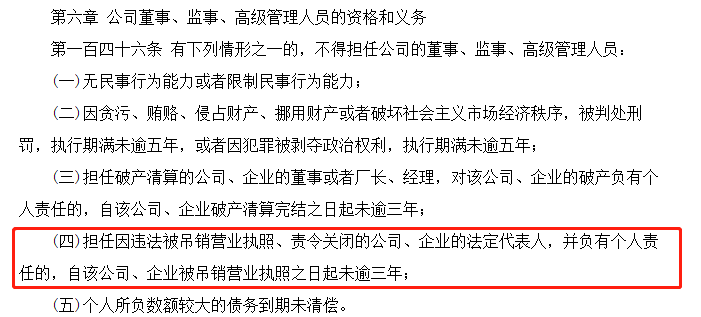

2. Cancellation of business license

For an enterprise that does not submit annual report as required for two consecutive years and fails to declare taxation, it is likely to have its business license suspended or canceled, which is an extremely severe administrative punishment.

In this circumstance, liquidation and registration cancellation are still necessary because shareholders and actual controllers of the enterprise bear certain liability for the enterprise. There’s a risk of economic disputes without liquidation.

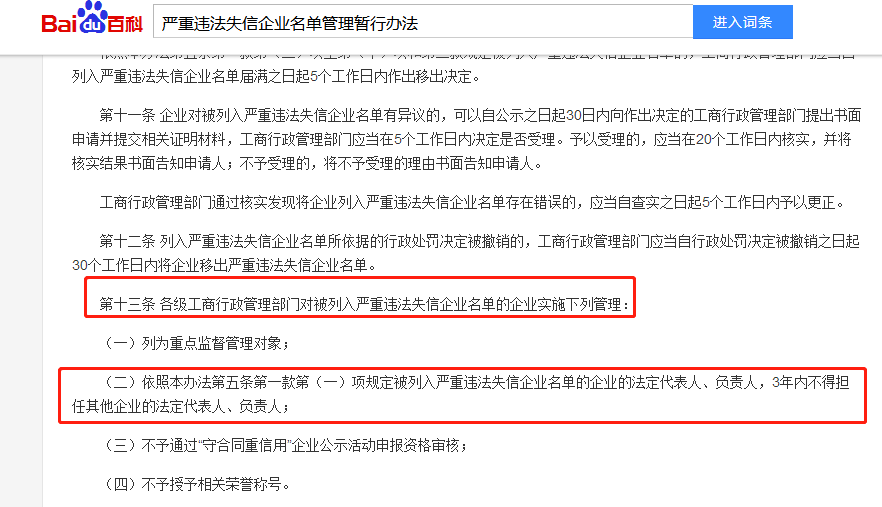

LIFE AND WORK RESTRICTIONS

1. Employment restrictions

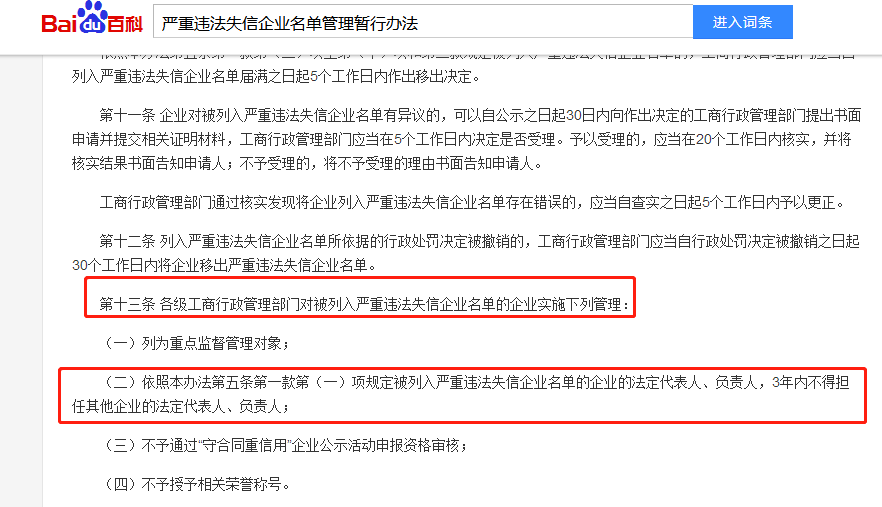

If an enterprise is listed as an enterprise with serious illegal and dishonest acts, its legal representative and the responsible person are not allowed to work as other enterprises’ legal representative or responsible person.

2. Life restrictions

The person involved will be restricted in various aspects of their life, such as exit-entry, transportation, bank loan, etc.

In summary, if your business is going tougher and tougher, you’d better formally close it. ‘Sleep mode’ is never a good option.

If you decided to cancel business registration, or have any questions about it, please feel free to contact us, HACOS will help you!

In order to help you reach the latest update on the global pandemic situation, HACOS has set a quick link on the menu of our WeChat page. Follow us, you can check it whenever you want!

Share to let your friends know!